In today’s rapidly evolving financial landscape, fintech companies require more than just code—they need innovation, domain expertise, and reliable long-term partnerships. Outsourcing software development to specialized firms allows financial institutions to access cutting-edge technologies while focusing on their core business. Below are five standout companies redefining fintech software outsourcing in 2025.

KMS Solutions

KMS Solutions stands out as one of the top fintech software outsourcing firms globally, offering bespoke development services for banks, insurers, and fintech enterprises. A subsidiary of the KMS Group, the company brings over 15 years of digital innovation experience to the table. Their solutions span mobile banking apps, trading platforms, digital onboarding, and insurance technology—custom-built to meet the specific challenges of the BFSI industry.

Recognized for its remarkable 260.35% growth rate, KMS Solutions earned 9th place on Clutch’s Top 100 Fastest-Growing B2B Providers list and won the Asia Pacific Enterprise Award (APEA) in 2022. With 130+ global clients, including ACB, TPBank, HDBank, and a top Australian bank, KMS offers unmatched financial software testing, technology consulting, and digital banking transformation, making it a go-to partner for enterprises worldwide.

Applify

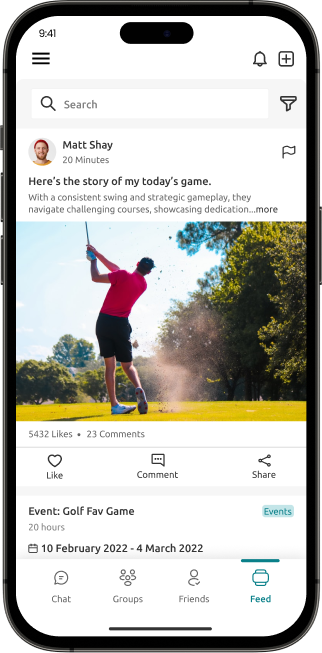

Applify, based in Australia, has carved a niche in developing sleek, scalable, and high-performing fintech applications. The company’s core strength lies in combining robust back-end development with user-centric UX/UI design, creating intuitive digital solutions for financial services, including mobile wallets, investment apps, and loan management platforms.

Known for staying ahead of tech trends, Applify ensures that its fintech solutions are not only functional but also future-ready. Their expertise makes them an ideal outsourcing partner for companies looking to modernize their digital ecosystem while enhancing customer experience across both web and mobile platforms.

Techne

Melbourne-based Techne specializes in custom fintech software development, with a strong emphasis on emerging technologies like blockchain, AI, and machine learning. Their developers create tailored banking and investment applications designed to handle modern financial demands, from real-time payments to personalized financial planning.

Techne’s collaborative approach and technical prowess have earned them a reputation as a trusted partner for startups and enterprises alike. Whether building a new mobile banking platform or integrating AI-powered tools into existing systems, Techne helps fintech companies stay competitive and innovative in a fast-paced market.

The NineHertz

The NineHertz brings a wealth of experience in developing end-to-end fintech software solutions, particularly known for its strength in mobile development. The company’s services span everything from mobile banking apps to peer-to-peer lending platforms, all designed with a focus on security, performance, and user experience.

Trusted by clients worldwide, NineHertz delivers scalable and compliant solutions tailored to specific business goals. Their commitment to collaboration and excellence makes them a preferred choice for fintech firms aiming to expand digital offerings and drive operational efficiency.

DianApps

DianApps has emerged as a top-tier software development partner for fintech firms looking for secure, scalable, and user-friendly applications. With expertise that spans consulting, architecture, development, and post-launch support, DianApps ensures that its clients receive end-to-end service for a seamless development journey.

The company’s innovative mindset and client-centric processes have made it a sought-after name in the financial software space. Whether it’s building a budgeting app, an insurance claims system, or a complex banking solution, DianApps delivers high-quality products that meet both business and regulatory needs.

To read more startup stories visit- startuptodayaustralia